Casual: Connections a world history volume 2 pdf download

| YOUTBUE DOWNLOADER FREE | 883 |

| WHERE TO PUT DOWNLOADED MINECRAFT MAPS ON MAC | 245 |

| FREE DOWNLOAD OF SI TU NOVIO TE DEJA SOLA | 133 |

| FRONT MISSION 5 SCARS OF THE WAR ISO DOWNLOAD | 590 |

| 50 BEST LOGO EVER PDF DOWNLOAD | 820 |

Executive summary

The Cisco Annual Internet Report is a global forecast/analysis that assesses digital transformation across various business segments (enterprise, small-to-medium business, public sector, and service provider). The report covers fixed broadband, Wi-Fi, and mobile (3G, 4G, 5G) networking. Quantitative projections are provided on the growth of Internet users, devices and connections as well as network performance and new application requirements. Qualitative analyses and assessments are also provided in four strategic areas: applications, security, infrastructure transformation, and empowering employees and teams.

Global Internet adoption and devices and connection

Internet users

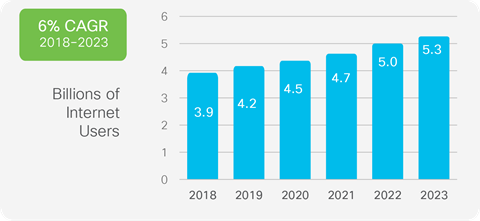

Nearly two-thirds of the global population will have Internet access by 2023. There will be 5.3 billion total Internet users (66 percent of global population) by 2023, up from 3.9 billion (51 percent of global population) in 2018.

Devices and connections

The number of devices connected to IP networks will be more than three times the global population by 2023. There will be 3.6 networked devices per capita by 2023, up from 2.4 networked devices per capita in 2018. There will be 29.3 billion networked devices by 2023, up from 18.4 billion in 2018.

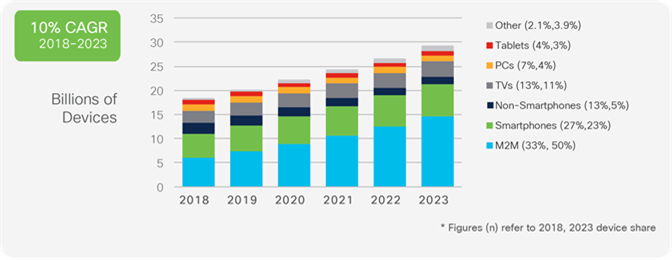

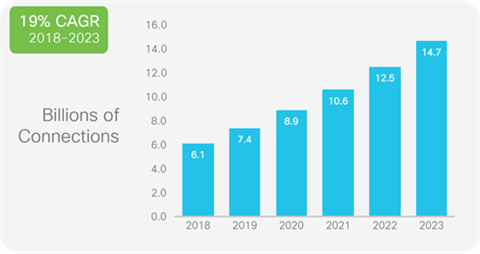

M2M connections will be half of the global connected devices and connections by 2023. The share of Machine-To-Machine (M2M) connections will grow from 33 percent in 2018 to 50 percent by 2023. There will be 14.7 billion M2M connections by 2023.

The consumer segment will have nearly three-fourths share of total devices and connections by 2023. Globally, consumer segment’s share of total devices and connections will be 74 percent, with the business segment claiming the remaining 26 percent.

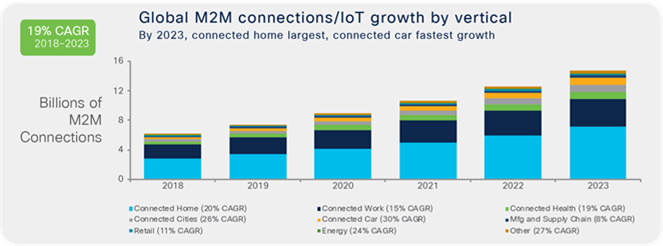

Internet of Things (IoT) by application

Within the M2M connections category (which is also referred to as IoT), connected home applications will have the largest share and connected car will be the fastest growing application type. Connected home applications will have nearly half or 48 percent of M2M share by 2023 and Connected car applications will grow the fastest at 30 percent CAGR over the forecast period (2018–2023).

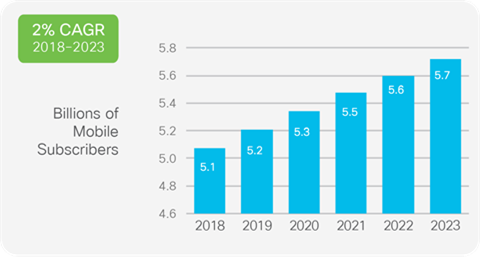

Mobility growth

Over 70 percent of the global population will have mobile connectivity by 2023. The total number of global mobile subscribers will grow from 5.1 billion (66 percent of population) in 2018 to 5.7 billion (71 percent of population) by 2023.

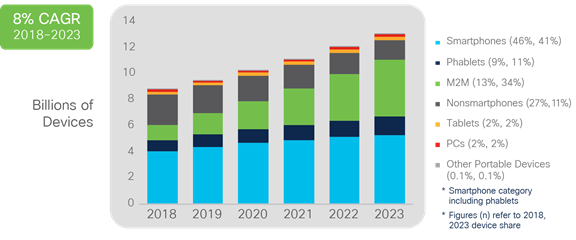

5G devices and connections will be over 10 percent of global mobile devices and connections by 2023. By 2023, global mobile devices will grow from 8.8 billion in 2018 to 13.1 billion by 2023 – 1.4 billion of those will be 5G capable.

The fastest growing mobile device category is M2M followed by smartphones. The mobile M2M category is projected to grow at a 30 percent CAGR from 2018 to 2023. Smartphones will grow at a 7 percent CAGR within the same period.

Global network performance

Accelerating speeds

Fixed broadband speeds will more than double by 2023. By 2023, global fixed broadband speeds will reach 110.4 Mbps, up from 45.9 Mbps in 2018.

Mobile (cellular) speeds will more than triple by 2023. The average mobile network connection speed was 13.2 Mbps in 2018 and will be 43.9 Mbps by 2023.

5G speeds will be 13 times higher than the average mobile connection by 2023. The average 5G connection speed will reach 575 Mbps by 2023.

Wi-Fi speeds from mobile devices will triple by 2023. Globally, the average Wi-Fi speeds will grow from 30.3 Mbps in 2018 to 92 Mbps by 2023.

Tiered pricing (Mobile)

The usage per month of the average top 1 percent of mobile users is steadily decreasing. Globally, the top 1 percent of mobile users generated 5 percent of mobile data in 2019. Back in 2010, the top 1 percent of mobile users generated 52 percent of mobile data.

Mobile applications

Nearly 300 million mobile applications will be downloaded by 2023. Globally, 299.1 billion mobile applications will be downloaded by 2023. Social media, gaming and business applications will be the most popular downloads.

Wi-Fi momentum

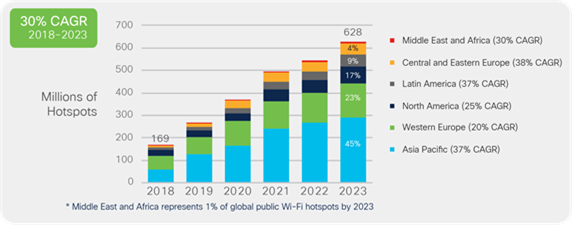

Wi-Fi hotspots will grow four-fold from 2018 to 2023. Globally, there will be nearly 628 million public Wi-Fi hotspots by 2023, up from 169 million hotspots in 2018.

Wi-Fi6 hotspots will grow 13-fold from 2020 to 2023 and will be 11 percent of all public Wi-Fi hotspots by 2023.

Security analysis

The number of breaches and total records exposed per breach continue to grow. Globally, there was a 776% growth in attacks between 100 Gbps and 400 Gbps Y/Y from 2018 to 2019, and the total number of DDoS attacks will double from 7.9 million in 2018 to 15.4 million by 2023.

Regional summaries

This section provides regional summaries for Internet users, devices and connections, and network performance. The Cisco Annual Internet Report covers six distinct geographic regions (in alphabetical order): Asia Pacific (APAC), Central and Eastern Europe (CEE), Latin America (LATAM), Middle East and Africa (MEA), North America (NA) and Western Europe (WE). Summary of regional growth rates:

● Asia Pacific (APAC)

◦ By 2023, APAC will have 3.1 billion Internet users (72 percent of regional population), up from 2.1 billion (52 percent of regional population) in 2018.

◦ By 2023, APAC will have 3.1 billion mobile users (72 percent of regional population), up from 2.7 billion (65 percent of regional population) in 2018.

◦ By 2023, APAC will have 13.5 billion networked devices/connections, up from 8.6 billion in 2018.

◦ By 2023, APAC will have 49 percent of all networked devices mobile-connected and 51 percent will be wired or connected over Wi-Fi.

◦ By 2023, APAC’s average fixed broadband speed will reach 157.1 Mbps, which represents 2.5-fold growth from 2018 (62.8 Mbps).

◦ By 2023, APAC’s average mobile connection speed will reach 45.7 Mbps, which represents 3.2-fold growth from 2018 (14.3 Mbps).

◦ By 2023, APAC’s average Wi-Fi speeds from mobile devices will reach 116 Mbps, which represents 3.4-fold growth from 2018 (34.5 Mbps).

● Central and Eastern Europe (CEE)

◦ By 2023, CEE will have 388 million Internet users (78 percent of regional population), up from 323 million (65 percent of population) in 2018.

◦ By 2023, CEE will have 404 million mobile users (81 percent of regional population), up from 394 million (79 percent of regional population) in 2018.

◦ By 2023, CEE will have 2.0 billion networked devices/connections, up from 1.2 billion in 2018.

◦ By 2023, CEE will have 48 percent of all networked devices mobile-connected and 52 percent will be wired or connected over Wi-Fi.

◦ By 2023, CEE’s average fixed broadband speed will reach 87.7 Mbps, which represents 2.5-fold growth from 2018 (35.0 Mbps).

◦ By 2023, CEE’s average mobile connection speed will reach 43.0 Mbps, which represents 3.3-fold growth from 2018 (12.9 Mbps).

◦ By 2023, CEE’s average Wi-Fi speeds from mobile devices will reach 53 Mbps, which represents 2.3-fold growth from 2018 (22.6 Mbps).

● Latin America (LATAM)

◦ By 2023, LATAM will have 470 million Internet users (70 percent of regional population), up from 387 million (60 percent of regional population) in 2018.

◦ By 2023, LATAM will have 520 million mobile users (78 percent of regional population), up from 482 million (75 percent of regional population) in 2018.

◦ By 2023, LATAM will have 2.1 billion networked devices/connections, up from 1.4 billion in 2018.

◦ By 2023, LATAM will have 49 percent of all networked devices mobile-connected and 51 percent will be wired or connected over Wi-Fi.

◦ By 2023, LATAM’s average fixed broadband speed will reach 59.3 Mbps, which represents 3.8-fold growth from 2018 (15.7 Mbps).

◦ By 2023, LATAM’s average mobile connection speed will reach 28.8 Mbps, which represents 3.6-fold growth from 2018 (8.0 Mbps).

◦ By 2023, LATAM’s average Wi-Fi speeds from mobile devices will reach 35.0 Mbps, which represents 3.3-fold growth from 2018 (10.6 Mbps).

● Middle East and Africa (MEA)

◦ By 2023, MEA will have 611 million Internet users (35 percent of regional population), up from 381 million (24 percent of regional population) in 2018.

◦ By 2023, MEA will have 1.0 billion mobile users (57 percent of regional population), up from 827 million (53 percent of regional population) in 2018.

◦ By 2023, MEA will have 2.6 billion networked devices/connections, up from 1.7 billion in 2018.

◦ By 2023, MEA will have 75 percent of all networked devices mobile-connected and 25 percent will be wired or connected over Wi-Fi.

◦ By 2023, MEA’s average fixed broadband speed will reach 41.2 Mbps, which represents 4.2-fold growth from 2018 (9.7 Mbps).

◦ By 2023, MEA’s average mobile connection speed will reach 24.8 Mbps, which represents 3.6-fold growth from 2018 (6.9 Mbps).

◦ By 2023, MEA’s average Wi-Fi speeds from mobile devices will reach 26 Mbps, which represents 3.7-fold growth from 2018 (7.0 Mbps).

● North America (NA)

◦ By 2023, NA will have 345 million Internet users (92 percent of regional population), up from 328 million (90 percent of regional population) in 2018.

◦ By 2023, NA will have 329 million mobile users (88 percent of regional population), up from 313 million (86 percent of regional population) in 2018.

◦ By 2023, NA will have 5.0 billion networked devices/connections, up from 3.0 billion in 2018.

◦ By 2023, NA will have 25 percent of all networked devices mobile-connected and 75 percent will be wired or connected over Wi-Fi.

◦ By 2023, NA’s average fixed broadband speed will reach 141.8 Mbps, which represents 2.5-fold growth from 2018 (56.6 Mbps).

◦ By 2023, NA’s average mobile connection speed will reach 58.4 Mbps, which represents 2.7-fold growth from 2018 (21.6 Mbps).

◦ By 2023, NA’s average Wi-Fi speeds from mobile devices will reach 110 Mbps, which represents 2.3-fold growth from 2018 (46.9 Mbps).

● Western Europe (WE)

◦ By 2023, WE will have 370 million Internet users (87 percent of regional population), up from 345 million (82 percent of regional population) in 2018.

◦ By 2023, WE will have 365 million mobile users (85 percent of regional population), up from 357 million (84 percent of regional population) in 2018.

◦ By 2023, WE will have 4.0 billion networked devices/connections, up from 2.4 billion in 2018.

◦ By 2023, WE will have 31 percent of all networked devices mobile-connected and 69 percent will be wired or connected over Wi-Fi.

◦ By 2023, WE’s average fixed broadband speed will reach 123.0 Mbps, which represents 2.7-fold growth from 2018 (45.6 Mbps).

◦ By 2023, WE’s average mobile connection speed will reach 62.4 Mbps, which represents 2.6-fold growth from 2018 (23.6 Mbps)

◦ By 2023, WE’s average Wi-Fi speeds from mobile devices will reach 97 Mbps, which represents 3.2-fold growth from 2018 (30.8 Mbps)

Trends

Section 1: Users/ Devices and connections

A. Growth in Internet users

Globally, the total number of Internet users is projected to grow from 3.9 billion in 2018 to 5.3 billion by 2023 at a CAGR of 6 percent. In terms of population, this represents 51 percent of the global population in 2018 and 66 percent of global population penetration by 2023 (Figure 1).

While the growth in the number of Internet users is a global trend, we do see regional variations (Table 1). While the region with the highest adoption throughout the forecast period is North America (followed by Western Europe), the fastest growth is projected to occur in the Middle East and Africa (10 percent CAGR expected from 2018 to 2023).

Table 1. Internet users as a percentage of regional population

Region | 2018 | 2023 |

Global | 51% | 66% |

Asia Pacific | 52% | 72% |

Central and Eastern Europe | 65% | 78% |

Latin America | 60% | 70% |

Middle East and Africa | 24% | 35% |

North America | 90% | 92% |

Western Europe | 82% | 87% |

B. Shifts in mix of devices and connections

Globally, devices and connections are growing faster (10 percent CAGR) than both the population (1.0 percent CAGR) and the Internet users (6 percent CAGR). This trend is accelerating the increase in the average number of devices and connections per household and per capita. Each year, various new devices in different form factors with increased capabilities and intelligence are introduced and adopted in the market. A growing number of M2M applications, such as smart meters, video surveillance, healthcare monitoring, transportation, and package or asset tracking, are contributing in a major way to the growth of devices and connections. By 2023, M2M connections will be half or 50 percent of the total devices and connections.

M2M connections will be the fastest-growing device and connections category, growing nearly 2.4-fold during the forecast period (19 percent CAGR) to 14.7 billion connections by 2023.

Smartphones will grow the second fastest, at a 7 percent CAGR (increasing by a factor of 1.4). Connected TVs (which include flat-panel TVs, set-top boxes, digital media adapters [DMAs], Blu-ray disc players, and gaming consoles) will grow next fastest (at a little less than a 6 percent CAGR), to 3.2 billion by 2023. PCs will continue to decline (a 2.3 percent decline) over the forecast period. However, there will more PCs than tablets throughout the forecast period and by the end of 2023 (1.2 billion PCs vs. 840 million tablets).

By 2023, the consumer share of the total devices, including both fixed and mobile devices, will be 74 percent, with business claiming the remaining 26 percent. Consumer share will grow at a slightly slower rate, at a 9.1 percent CAGR relative to the business segment, which will grow at a 12.0 percent CAGR.

Globally, the average number of devices and connections per capita will grow from 2.4 in 2018 to 3.6 by 2023 (Table 2).

Among the countries that will have the highest average of per capita devices and connections by 2023 are the United States (13.6), South Korea (12.1), and Japan (11.1).

Table 2. Average number of devices and connections per capita

Region | 2018 | 2023 |

Global | 2.4 | 3.6 |

Asia Pacific | 2.1 | 3.1 |

Central and Eastern Europe | 2.5 | 4.0 |

Latin America | 2.2 | 3.1 |

Middle East and Africa | 1.1 | 1.5 |

North America | 8.2 | 13.4 |

Western Europe | 5.6 | 9.4 |

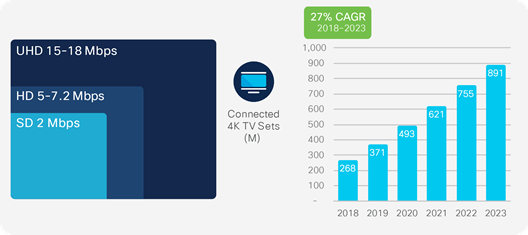

It is important to track the changing mix of devices and connections and growth in multidevice ownership as it affects traffic patterns. Video devices, in particular, can have a multiplier effect on traffic. An Internet-enabled HD television that draws couple - three hours of content per day from the Internet would generate as much Internet traffic as an entire household today, on an average. Video effect of the devices on traffic is more pronounced because of the introduction of Ultra-High-Definition (UHD), or 4K, video streaming. This technology has such an effect because the bit rate for 4K video at about 15 to 18 Mbps is more than double the HD video bit rate and nine times more than Standard-Definition (SD) video bit rate. We estimate that by 2023, two-thirds (66 percent) of the installed flat-panel TV sets will be UHD, up from 33 percent in 2018 (Figure 3).

C. M2M applications across many industries accelerate IoT growth

Internet of Things (IoT) have become a prevalent system in which people, processes, data, and things connect to the Internet and each other. Globally, M2M connections will grow 2.4-fold, from 6.1 billion in 2018 to 14.7 billion by 2023 (Figure 4). There will be 1.8 M2M connections for each member of the global population by 2023.

Connected home applications, such as home automation, home security and video surveillance, connected white goods, and tracking applications, will represent 48 percent, or nearly half, of the total M2M connections by 2023, showing the pervasiveness of M2M in our lives (Figure 5). Connected car applications such as fleet management, in-vehicle entertainment systems, emergency calling, Internet, vehicle diagnostics and navigation etc. will be the fastest-growing category, at a 30 percent CAGR. Connected cities applications will have the second-fastest growth, at 26 percent CAGR.

While traditionally the traffic from M2M connections has been less than that from the end user devices such as smartphones, TV sets and PCs, we estimate that the amount of traffic is growing faster than the number of connections because of the increase of deployment of video applications on M2M connections and the increased use of applications, such as telemedicine and smart car navigation systems, which require greater bandwidth and lower latency.

D. Mobility on the rise

Globally, the total number of mobile subscribers (those subscribing to a cellular service) is going to grow from 5.1 billion in 2018 to 5.7 billion by 2023 at a CAGR of 2 percent. In terms of population this represents 66% of global population in 2018 and 71% of global population penetration by 2023 (Figure 6). Relative to the growth in Internet users we see slow down occurring in the mobile subscriber growth – this is primarily as the penetration levels have already crossed 60 percent range.

While there are regional differences in the mobile subscriber penetration of the regional population (Table 3), the range of variations is much smaller relative to the overall Internet users that we saw in the previous analysis. While the region with the highest adoption throughout the forecast period is North America, followed by Western Europe, the fastest growth is going to occur in Middle East and Africa at 4 percent CAGR from 2018 to 2023. While the adoption rates for mobile (above 60 percent of the population in 2018) are already quite high across all regions, we do see that Middle East and Africa has a bit of catch up to do and that is reflected in higher growth rates relative to other regions.

Table 3. Mobile subscribers as a percentage of regional population

Region | 2018 | 2023 |

Global | 66% | 71% |

Asia Pacific | 65% | 72% |

Central and Eastern Europe | 79% | 81% |

Latin America | 75% | 78% |

Middle East and Africa | 53% | 57% |

North America | 86% | 88% |

Western Europe | 84% | 85% |

The ever-changing mix and growth of wireless devices that are accessing mobile networks worldwide is one of the primary contributors to global mobile traffic growth. Each year several new devices in different form factors and increased capabilities and intelligence are introduced in the market. In the last couple of years, we have seen a rise of phablets and more recently we have seen many new M2M connections coming into the mix. There were 8.8 billion global mobile devices and connections in 2018, which will grow to 13.1 billion by 2023 at a CAGR of 8 percent (Figure 7).

By 2023, there will be 8.7 billion handheld or personal mobile-ready devices and 4.4 billion M2M connections (e.g., GPS systems in cars, asset tracking systems in shipping and manufacturing sectors, or medical applications making patient records and health status more readily available, et al.). Regionally, North America and Western Europe are going to have the fastest growth in mobile devices and connections with 16 percent and 11 percent CAGR from 2018 to 2023, respectively.

We see a rapid decline in the share of non-smartphones from 27 percent in 2018 (2.4 billion) to 11 percent by 2023 (1.5 billion). Another significant trend is the growth of smartphones (including phablets) from 4.9 billion in 2018 to 6.7 billion by 2023 at the second highest CAGR of 7 percent. Even though smartphones are growing absolutely, the relative share is declining from 56 percent in 2018 to 51 percent by 2023. This is because of the most noticeable growth in M2M connections. M2M mobile connections will cross over a third (34 percent) of total devices and connections by 2023. The M2M category is going to grow at 30 percent CAGR from 2018 to 2023. Along with the overall growth in the number of mobile devices and connections, there is clearly a visible shift in the device mix.

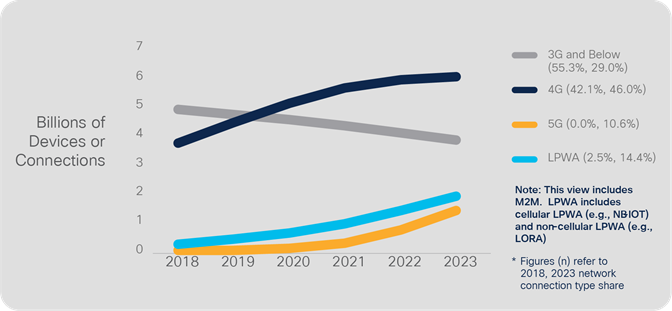

Defining Cell Network Advances—2G, 3G, 4G and 5G Projections

Mobile devices are evolving from lower-generation network connectivity (2G) to higher-generation network connectivity (3G, 3.5G, 4G or LTE and now also 5G). Combining device capabilities with faster, higher bandwidth and more intelligent networks will facilitate broad experimentation and adoption of advanced multimedia applications that contribute to increased mobile and Wi-Fi traffic.

The explosion of mobile applications and the expanded reach of mobile connectivity to a growing number of end users has prompted the need for optimized bandwidth management and new network monetization models to sustain a maturing mobile industry. In a highly competitive mobile market, we have seen the growth of global 4G deployments as well as early-stage 5G implementations.

Last year we saw that 4G surpassed all other connection types, in this year’s analysis we’ve combined 3G and below networks into one category – 4G will surpass that category by 2019 and will be the predominant mobile network connectivity throughout the remaining forecast period. By 2023, 4G connections will be 46% of total mobile connections, compared to 42% in 2018 (Figure 8). The global mobile 4G connections will grow from 3.7 billion in 2018 to 6.0 billion by 2023 at a CAGR of 10 percent. 5G connections will appear on the scene in 2019 and will grow over 100-fold from about 13 million in 2019 to 1.4 billion by 2023. 5G connectivity is emerging from nascency to a strong contender for mobile connectivity driven by mobile IoT growth. By 2023, there will be 11% devices and connections with 5G capability.

Starting this year, we are combining our analysis of 2G and 3G into 3G and below category as the lack of source data has made it difficult to split the two categories. There were 55% 3G and below connections in 2018, but by the end of the forecast period, these will decline to 29%.

We also include Low-Power Wide-Area (LPWA) connections in our analysis. This type of ultra-narrowband wireless network connectivity is meant specifically for M2M modules that require low bandwidth and wide geographic coverage. It provides high coverage with low power consumption, module, and connectivity costs, thereby creating new M2M use cases for Mobile Network Operators (MNOs) that cellular networks alone could not have addressed. Examples include utility meters in residential basements, gas or water meters that do not have power connection, streetlights, and pet or personal asset trackers. The share of LPWA connections (all M2M) will grow from about 2.5 percent in 2018 to 14 percent by 2023, from 223 million in 2018 to 1.9 billion by 2023.

This transition from 3G and below to 4G and now 5G deployment is a global trend (Table 4). In fact, by 2023, nearly 60 percent of the mobile devices and connections globally will have 4G+ capability, surpassing 3G and below-capable devices and connections by several fold. North America will have the highest share of its devices and connections on 4G+ connectivity – 62 percent, by 2023. Middle East and Africa at 73% will have the highest share of its devices and connections on 3G and below by 2023. By 2023, North America with 37 percent and Western Europe with 28 percent share will be the two regions with highest LPWA adoption. By 2023, North America will be the region with highest share of connections on 5G at 17 percent.

Table 4. Mobile connections by network type – 2023 regional percentage share

Region | 3G and Below | 4G | 5G | LPWA |

Global | 29 | 46 | 11 | 14 |

Asia Pacific | 23 | 52 | 13 | 12 |

Central and Eastern Europe | 31 | 50 | 2 | 16 |

Latin America | 37 | 50 | 2 | 16 |

Middle East and Africa | 73 | 22 | 1 | 4 |

North America | 1 | 45 | 17 | 37 |

Western Europe | 13 | 43 | 16 | 28 |

The top three 5G countries in terms of percent of devices and connections share on 5G will be China (20.7%), Japan (20.6%), and United Kingdom (19.5%), by 2023.

Mobile IoT adoption—M2M

The phenomenal growth in mobile end-user devices and M2M connections is a clear indicator of the growth of mobile IoT, which is bringing together people, processes, data, and things to make networked connections more relevant and valuable.

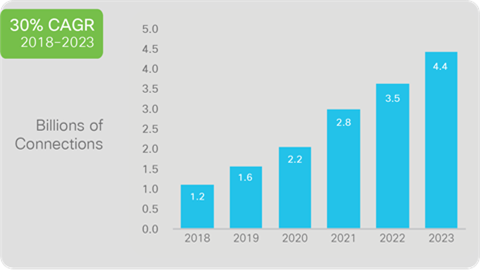

Globally, mobile M2M connections will grow from 1.2 billion in 2018 to 4.4 billion by 2023, a 30 percent CAGR—a four-fold growth. (Figure 9).

Section 2: Network performance and user experience

A. Wi-Fi continues to gain momentum

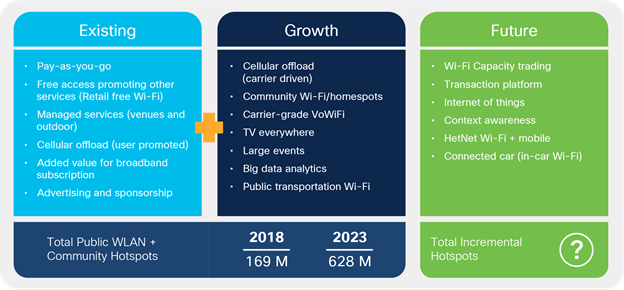

One of the main solutions to meet the demands of the increasing demand for bandwidth has long been leveraging Wi-Fi networks, which enables operators to scale capacity to meet their subscribers’ needs. With advances and ratifications in Wi-Fi standards, dense environments with many concurrently connecting devices and IoT connections such as airports, public transportation, retail, healthcare, smart cities, stadiums etc. result in public wi-fi use cases across industry segments. Globally, there will be nearly 628 million public Wi-Fi hotspots by 2023, up from 169 million hotspots in 2018, a fourfold increase.

By 2023, Asia Pacific will have the highest share of global public Wi-Fi hotspots at 46 percent. Public Wi-Fi along with community hotspots are included in the forecast. Community hotspots or homespots have emerged as a potentially significant element of the public Wi-Fi landscape. In this model, subscribers allow part of the capacity of their residential gateway to be open to casual use. The homespots may be provided by a broadband or other provider directly or through a partner. Asia Pacific will lead in adoption of homespots. By 2023, China will lead in total number of homespots, followed by the United States and Japan.

Retail establishments will have the highest number of hotspots by 2023 globally, and the fastest growth is in healthcare facilities (hospitals), where hotspots will triple over the forecast period. The primary objective of Wi-Fi in hospitals is to improve the delivery of healthcare services and staff productivity, with a secondary benefit being Internet access for patients, their families, and their guests.

Integral to these verticals and looking into the future are the game-changing IoT devices and connections. According to the WBA Alliance, there is a need to find a dynamic way for IoT devices to search for a computable network and automatically roam between Wi-Fi and mobile networks at scale without intervention. Additionally, interest in data analytics and recommendation engines resulting in Wi-Fi advertising and location services is growing as service providers search for new ways to monetize Wi-Fi and generate new revenue streams.

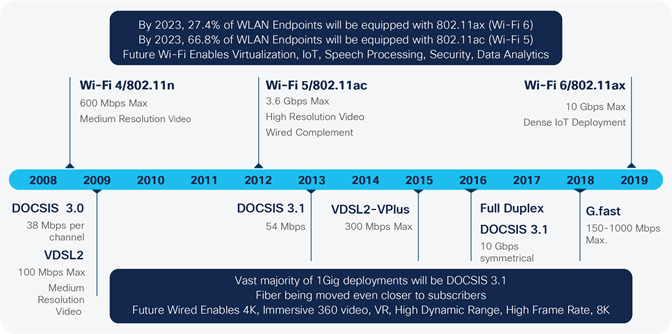

Critical enablers of Hotspot 2.0 adoption are higher speed Wi-Fi gateways and the adoption of the IEEE 802.11ac or Wi-Fi 5 and the latest 802.11ax or Wi-Fi 6 standards. Globally, Wi-Fi 6 hotspots will grow 13-fold from 2020-2023 and will be 11% of all public Wi-Fi hotspots by 2023.

The prevalence of IEEE 802.11ac, the latest Wi-Fi standard, will gain momentum from 2018 through 2023. By 2023, 66.8 percent of all WLAN endpoints will be equipped with 802.11ac or Wi-Fi 5. IEEE 802.11n or Wi-Fi 4, which was ratified in 2007, provides a range of speeds that allow users to view medium-resolution video streaming because of the higher throughput. IEEE 802.11ac, with very high theoretical speeds, is considered a true wired complement and can enable higher definition video streaming and services with use cases that require higher data rates. The latest 802.11ax or Wi-Fi 6 is also called the High-Efficiency Wireless (HEW), has the goal of improving the average throughput per user by a factor of at least four times in dense user environments. It will enable dense IoT deployments. By 2023, 27.4 percent of all WLAN endpoints will be equipped with 802.11ax (Figure 12).

Wi-Fi has a powerful role to play alongside other small cell technologies in delivering key use cases going forward in the 5G Era.

B. Effects of accelerating speeds on traffic growth

Broadband speed is a crucial enabler of IP traffic. Broadband-speed improvements result in increased consumption and use of high-bandwidth content and applications. The global average broadband speed continues to grow and will more than double from 2018 to 2023, from 45.9 Mbps to 110.4 Mbps. Table 5 shows the projected broadband speeds from 2018 to 2023. Several factors influence the fixed broadband-speed forecast, including the deployment and adoption of Fiber-To-The-Home (FTTH), high-speed DSL, and cable broadband adoption, as well as overall broadband penetration. Among the countries covered by this study, Japan, South Korea, and Sweden lead in terms of broadband speed largely because of their wide deployment of FTTH.

Table 5. Fixed broadband speeds (in Mbps), 2018–2023

Region | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR (2018–2023) |

Global | 45.9 | 52.9 | 61.2 | 77.4 | 97.8 | 110.4 | 20% |

Asia Pacific | 62.8 | 74.9 | 91.8 | 117.1 | 137.4 | 157.1 | 20% |

Latin America | 15.7 | 19.7 | 34.5 | 41.2 | 51.5 | 59.3 | 30% |

North America | 56.6 | 70.1 | 92.7 | 106.8 | 126.0 | 141.8 | 20% |

Western Europe | 45.6 | 53.2 | 72.3 | 87.4 | 105.6 | 123.0 | 22% |

Central and Eastern Europe | 35.0 | 37.2 | 57.0 | 65.5 | 77.8 | 87.7 | 20% |

Middle East and Africa | 9.7 | 11.7 | 25.0 | 29.0 | 34.9 | 41.2 | 33% |

Consider how long it takes to download an HD movie at these speeds: at 10 Mbps, it takes 20 minutes; at 25 Mbps, it takes 9 minutes; but at 100 Mbps, it takes only 2 minutes. High-bandwidth speeds will be essential to support consumer cloud storage, making the download of large multimedia files as fast as a transfer from a hard drive. Table 6 shows the percentage of broadband connections that will be faster than 10 Mbps (96 percent by 2023), 25 Mbps (88 percent by 2023), and 100 Mbps (39 percent by 2023) by region.

Table 6. Broadband speed greater than 10 Mbps, 2018–2023

Region | Greater Than 10 Mbps | |||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

-

-